tp 584 1 instructions

- by zachery

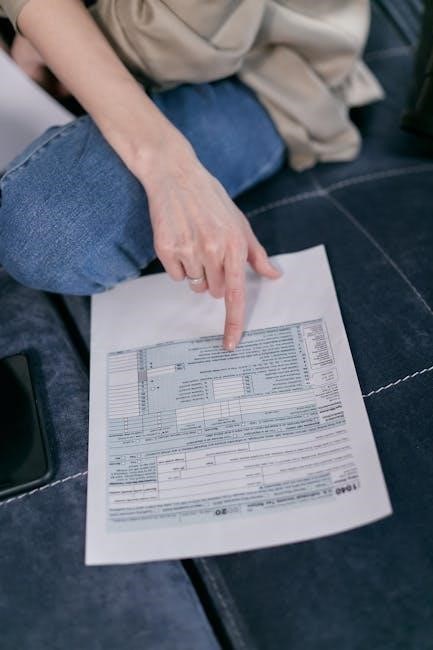

Form TP-584 is a combined form for real estate transfer tax, credit line mortgage certificates, and exemption from personal income tax. It streamlines filing procedures for grantors and grantees, ensuring compliance with New York State tax laws through detailed reporting of property conveyances and tax computations.

1.1 Purpose of the Form

Form TP-584 is designed to report real estate conveyances, ensuring compliance with New York State tax laws. It combines the real estate transfer tax return, credit line mortgage certificate, and certification for exemption from personal income tax. The form facilitates accurate reporting of property transfers, tax computations, and exemptions, streamlining the process for grantors and grantees to meet legal requirements efficiently.

1.2 Overview of Filing Requirements

Form TP-584 must be filed with the appropriate authorities upon the conveyance of real property or cooperative units. The form ensures compliance with tax laws, including real estate transfer taxes and mortgage taxes. Filing is mandatory for all applicable transactions, with specific deadlines to avoid penalties. Exemptions and special cases are outlined, and additional schedules may be required based on the conveyance type. Timely submission is crucial to meet legal obligations and prevent late filing consequences.

Who Must File Form TP-584

Both grantors and grantees involved in real property conveyances must file Form TP-584 to comply with New York State tax requirements and ensure proper documentation of the transaction.

2.1 Grantors and Grantees

Grantors (sellers/transferors) and grantees (buyers/transferees) involved in real property conveyances must file Form TP-584. Grantors are responsible for accurately reporting property details, while grantees ensure compliance with tax obligations. Both parties must sign certifications, confirming the validity of the information provided. This ensures transparency and accountability in the transaction, adhering to New York State tax laws. Failure to comply may result in penalties, emphasizing the importance of accurate and timely filing by both parties.

2.2 Exemptions and Special Cases

Certain conveyances are exempt from Form TP-584 requirements, such as transfers between family members or government entities. Specific exemptions apply to foreclosure-related conveyances, with detailed instructions provided in the form. Special cases may require additional documentation to validate exemptions, ensuring compliance with state tax regulations. Understanding these exceptions is crucial for accurate filing and avoiding unnecessary penalties or delays in the transaction process.

Key Components of Form TP-584

Schedule A requires detailed property information, including location, tax lot number, and date of conveyance, ensuring accurate reporting of real estate transactions for tax purposes.

3.1 Schedule A — Property Information

Schedule A requires detailed property information, including the location, tax lot number, and date of conveyance. It also mandates the names and addresses of both the grantor and grantee. This section ensures accurate reporting of the property’s identity and the parties involved in the transaction. Proper completion of Schedule A is essential for compliance with New York State tax regulations and facilitates efficient processing of the conveyance. All information must be precise to avoid delays or penalties.

3.2 Schedule B ⸺ Tax Computation

Schedule B is used to calculate the real estate transfer tax and credit line mortgage tax. It requires entering the consideration for conveyance, which may include cash, debt, or other liabilities. The tax due is computed based on the taxable amount, with specific rates applied according to New York State regulations. Additional taxes, such as the base and supplemental taxes for NYC, are also addressed here. Accurate computation ensures compliance and avoids penalties, making it crucial to follow instructions carefully.

3.3 Schedule E — Additional Conveyance Information

Schedule E provides additional details about the conveyance, particularly for transactions involving foreclosure, liens, or security interests. It requires information such as the amount of any remaining liens or encumbrances post-conveyance and the nature of the transaction. This schedule is essential for accurately determining tax liabilities and ensuring compliance with specific conveyance rules. It must be completed when applicable, as outlined in the instructions, to avoid delays or penalties in processing the transfer tax return.

Instructions for Completing Schedule A

Schedule A requires detailed property information, including descriptions, locations, and tax-specific details. Accurately enter the property address, tax lot number, and relevant identifiers to ensure proper reporting.

4.1 Entering Property Details

Enter the property address, tax lot number, and identifiers accurately. Include street number, city, state, and ZIP code. Specify if the property is residential, commercial, or vacant land. For cooperatives, provide unit and building details. Ensure consistency with the deed to avoid discrepancies. Verify all information matches tax records for accurate reporting. This ensures compliance with transfer tax requirements and prevents filing delays.

4.2 Certifications and Signatures

Both grantor and grantee must sign and date the form, certifying accuracy of provided information. New York State residents must sign the certification in Part I if listed in Schedule A. Signatures confirm compliance with tax laws and acknowledge penalties for false statements. Ensure all parties sign legibly, maintaining records for audit purposes. Proper certification ensures timely processing of the conveyance and avoids delays or penalties.

Instructions for Completing Schedule B

Schedule B requires detailed tax computation, including real estate transfer tax and mortgage tax. Enter consideration for conveyance and calculate tax due, ensuring accuracy for timely processing.

5.1 Computation of Tax Due

Compute the tax due by applying the real estate transfer tax rate to the property’s sale price or fair market value. Consider any liens or encumbrances that may reduce the taxable amount. Ensure accurate entry of all values on Schedule B, following specific line instructions. Apply any applicable exemptions or credits to minimize tax liability. Refer to official instructions or provided examples for guidance.

5.2 Consideration for Conveyance

Enter the total consideration received for the conveyance, including cash, property, or services exchanged. Report the amount on Schedule B, Part I, Line 1. For foreclosures, use the judgment amount or bid price. Ensure the figure reflects the fair market value or sale price, minus any remaining liens or encumbrances. Accurate reporting is crucial for tax computation. Refer to specific line instructions for guidance on complex transactions or exemptions.

Special Instructions for Part I

Part I covers conveyances under foreclosure or Real Property Actions and Proceedings Law. Enter judgment amount or bid price for accurate tax computation. Ensure compliance with specific line instructions for complex transactions.

6.1 Conveyance Pursuant to Foreclosure

A conveyance pursuant to foreclosure requires detailed reporting on Form TP-584. When real property is transferred due to foreclosure or actions under the Real Property Actions and Proceedings Law, the grantee is typically the mortgagee or lienor. The amount of the foreclosure judgment or bid price must be entered accurately. This section ensures proper tax computation and compliance with legal requirements. Signatures and certifications are mandatory for grantors or transfereors. Additional liens or encumbrances remaining post-conveyance must also be disclosed. Failure to comply may result in penalties.

6.2 Amount of Judgment or Bid Price

The amount of judgment or bid price must be accurately reported on line 1 of Schedule B, Part I. This applies to conveyances resulting from foreclosure or actions under the Real Property Actions and Proceedings Law. The bid price or judgment amount is critical for tax computation. Any remaining liens or encumbrances post-conveyance must also be disclosed. Proper reporting ensures accurate tax assessment and compliance with legal requirements. Failure to report correctly may lead to penalties or delays in processing.

Additional Taxes and Requirements

Additional taxes include New York City base and supplemental taxes for certain conveyances. Payment of estimated personal income tax may also be required, ensuring compliance with all tax obligations.

7.1 New York City Base and Supplemental Taxes

As of July 1, 2019, certain real property conveyances in New York City are subject to an additional base tax and a supplemental tax. These taxes are calculated based on the property’s value and are imposed in addition to the standard real estate transfer tax. The base tax applies to all qualifying conveyances, while the supplemental tax varies depending on the property’s sale price. It is essential to consult Form TP-584-I for specific calculation instructions and filing requirements to ensure compliance with NYC tax regulations.

7.2 Payment of Estimated Personal Income Tax

The payment of estimated personal income tax is required for certain real property transfers in New York State. This ensures compliance with tax obligations arising from the sale or transfer of property. Grantors must certify exemption or payment on Form TP-584, Schedule B, Part I. Failure to meet this requirement may result in penalties. It is crucial to review the instructions provided in Form TP-584-I to understand specific scenarios and ensure timely payment to avoid any tax-related issues.

Filing Requirements and Deadlines

Timely submission of Form TP-584 is mandatory to avoid penalties. Late filing may result in additional charges. Adhering to deadlines ensures compliance and prevents financial penalties.

8.1 Timely Submission of Form TP-584

Form TP-584 must be submitted within specific deadlines to avoid penalties. The form should be filed with the appropriate authorities at the time of the conveyance. Timely submission ensures compliance with tax laws and prevents additional charges. Late submissions may incur penalties and interest. It is crucial to adhere to the specified deadlines to maintain compliance and avoid financial repercussions. Proper filing ensures smooth processing and avoids legal complications.

8.2 Consequences of Late Filing

Late filing of Form TP-584 results in penalties and interest. New York State imposes a fee for untimely submissions, calculated based on the unpaid tax amount and the number of late days. Additional legal actions may be taken if the form remains unfiled. Ensuring timely submission is essential to avoid these consequences and maintain compliance with state tax regulations.

Form TP-584 is essential for real estate transactions in New York, ensuring compliance with tax laws. Accurate and timely filing avoids penalties, while resources are available for further guidance.

9.1 Final Checklist for Form TP-584

- Review property details in Schedule A for accuracy.

- Ensure tax computations in Schedule B are correct.

- Verify all certifications and signatures are complete.

- Confirm conveyance information in Schedule E is accurate.

- Check for additional taxes or exemptions.

- Ensure timely submission to avoid penalties.

This checklist ensures all requirements are met for a compliant filing.

9.2 Resources for Further Assistance

For additional guidance, visit the official New York State Department of Taxation and Finance website. Refer to Form TP-584-I for detailed instructions and examples. Contact tax professionals or legal experts for personalized advice. Ensure compliance by consulting the latest tax laws and regulations. Utilize online resources for updated forms and filing deadlines to avoid penalties.

Related posts:

Discover expert Judaica instructions, tips, and guides at Mojudaica. Enhance your Jewish traditions with our comprehensive resources.

Posted in Instructions

Recent Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023